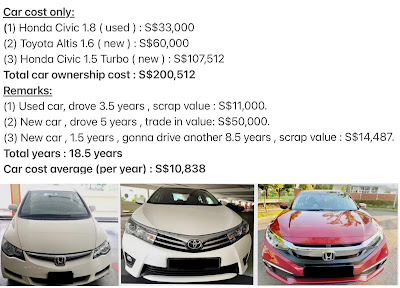

HONDA CIVIC 1.5 TURBO: (Year 2020 - Present)

TOYOTA ALTIS 1.6: (Year 2015 - Year 2020)

HONDA CIVIC 1.8: (Year 2012 - Year 2015)

Just the car cost itself (with COE of course), the total car ownership cost for 18.5 years is S$200,512.

In average, S$10,838 per year.

Revision 05 (last paragraph): updated on January 4, 2022.

Revision 04: updated on February 28, 2021.

Revision 03: updated on September 29, 2020.

Revision 02: updated on December 15, 2015.

I bought my first used car in April 2012. A pearl white Honda Civic 1.8 lit with a price tag of S$44,000. I have scrapped the car earlier in November 2015 with a return value of S$11,000. My COE will be expire in February 2016 instead.

So, literally, the car cost was S$33,000 for 3.5 years of usage (after getting back the car scrap value).

April 2012 - car mileage was 84,206 KM

November 2015 - car mileage was 117,064 KM

In this 3.5 years of car usage, the car mileage clocked total of 32,858 KM.

In average, I run the car for 9,388 KM per year.

I finally know why everyone said Honda Civic is a reliable car.

For the past 3.5 years , I only spent S$2,344 for the car maintenance. It is average S$669+ per year! I only do car standard maintenance once in a year !

The Honda Civic car engine gave me zero problem for a nearly 10th year old car, can you believe it ? Zero problem !

Out from this S$2,344 car maintenance cost, it is good to point out the following items:

(1) I spent S$500 for 4 pieces of new car tyres.

(2) I changed my car battery in October 2012 and it still run well in November 2015 ! The car battery last for 3 years and more ! It is worth to mention the car battery is AMARON (12V 45 MAH type).

Hence, my maintenance cost for this car was S$3,769.20. It includes new tyres cost of S$565.

I bought my first used car in April 2012. A pearl white Honda Civic 1.8 lit with a price tag of S$44,000. I have scrapped the car earlier in November 2015 with a return value of S$11,000. My COE will be expire in February 2016 instead.

So, literally, the car cost was S$33,000 for 3.5 years of usage (after getting back the car scrap value).

My beautiful used car:

November 2015 - car mileage was 117,064 KM

In this 3.5 years of car usage, the car mileage clocked total of 32,858 KM.

In average, I run the car for 9,388 KM per year.

I finally know why everyone said Honda Civic is a reliable car.

For the past 3.5 years , I only spent S$2,344 for the car maintenance. It is average S$669+ per year! I only do car standard maintenance once in a year !

The Honda Civic car engine gave me zero problem for a nearly 10th year old car, can you believe it ? Zero problem !

Out from this S$2,344 car maintenance cost, it is good to point out the following items:

(1) I spent S$500 for 4 pieces of new car tyres.

(2) I changed my car battery in October 2012 and it still run well in November 2015 ! The car battery last for 3 years and more ! It is worth to mention the car battery is AMARON (12V 45 MAH type).

Of course, you have to pay insurance and road tax every year.

Road tax for 1.8 lit car is S$978 per year.

Car insurance average is S$1,600 and it will go lower and

lower. I have yet to reach the 50% no claim limit discount.

Last but not least, you also need to include the

car park fees and petrol cost.

In summary, I love Honda Civic car a lot. It is truly a fun car to drive.

I have since bought a brand new Toyota Altis in November 2015 and I will

share more about the experience with Toyota here. Of course , Honda Civic is

better than Altis but in terms of price, of course, Altis

presents a much better value car, that is the key reason I

bought Altis especially the new version of Altis looks so much better than

the older generation, so, why not give it a try ?

So, this blog will be a continuous blog of my car experience with

Toyota Altis thereafter. :)

Updated on December 15, 2015

=======================

Toyota Altis: (mine is pearl white again)

I bought a new Toyota Altis in early November 2015 with a

price tag of S$110,000 nett.

It is a 1.6 lit. pearl white

elegance series. It is a free upgrade that worth S$7,000.

This also include free 1 year servicing (4 times @ 1,000

KM, 5,000 KM, 10,000 KM and 20,000 KM). It has

5 years warranty for the car engine with unlimited mileage.

It is worth to take note the road tax for 12 months is now

S$594 for a 1.6 lit. car.

The COE secured is S$56,001.

Do let me know if the Altis elegance series price start

to drop below S$110,000 level. That has to be in line

with the COE price drop, obviously.

My new baby now:

After driving almost 900 KM with Toyota Altis, let me share some views of

this car in comparison with Honda Civic.

What I like:

(1) The price is great. At least it is cheaper than Honda Civic

by S$15,000. I can use the price difference for Altis

maintenance cost for 10 years ! :)

(2) The car looks great. The doors look like Lexus IS250.

:)

(3) Even though it is a 1.6 lit car, the power is still not bad, acceptable.

(4) The noise isolation of this Altis is superb. It is

extremely quiet once you close the door. I am impressed.

(5) Extremely fuel efficient. I will share more on that.

(6) And many more small little items like key less ignition, electric

adjustable seat, built in GPS, auto LED light.

What I think it can be better:

(1) The steering wheel is too light for me but I somehow get used to it.

(2) The movement of the gear box is like a toy. Oh boy, luckily I don't have

to change gear often like a manual car. The movement is not shiok like Honda

Civic.

(3) The car compartment design is really bad. They should just

copy Honda Civic. Civic compartment in the car is super.

Toyota Altis has a scrap value of

S$9,800

Honda Civic scrap value is S$10,000

Honda City scrap value is S$4,500.

I have once calculated the

standard and major maintenance

until 80,000 KM ( I

probably only able to clock 80,000 KM in 10 years time or lesser). The

maintenance cost would be

S$ 1,575 for

10 years from

Toyota Service Centre. That's not too bad indeed. (The cost breakdown will be shared in the next

revision).

Updated on September 29, 2020

=======================

I will trade in the Toyota Altis on October 13, 2020 for S$50,000 and I lost the car scrap value of S$9,800.

Technically speaking , I paid S$60,000 to drive the new car for 5 years.

S$12,000 to own the car for a year.

I have driven about 75,000 KM.

My next servicing is scheduled to be end of Q4 2020 and I skipped it due to the trade in.

Hence, my maintenance cost for this car was S$3,769.20. It includes new tyres cost of S$565.

In average, I pay S$753 per year. The cost does not include the road tax, VICOM car test, ERP, car park fees, etc..

As for the car insurance paid for the past 5 years, total paid: S$4,300++.

Goodbye Toyota Altis.

It is indeed a good reliable Japanese car. No problem at all.

Updated on February 28, 2021

========================

(1) 13th October 2020

- New car collection!

- FREE 6 months road tax worth S$342.

- 5 years extended warranty (unlimited mileage)

- FREE 3 years servicing (7 times or up to 60,000KM)

- FREE front recording camera

- FREE Honda coilmat

- COE: S$41,510

- KahShield Undercoating/ Rustproofing, paid S$256.80.

- After 10 years scrap value will be S$14,487 (Minimum PARF Benefit)

(2) 30th October 2020

- paid S$540 for BlackNano coating (including windscreen coating on all glass panels, GYEON RIMS coating on all 4 rims, Interior coated with GYEON leather COAT and head and tail lamps coating. 36 months warranty, where covering gloss, uneveness of coating as well as peeling and cracking on the coating.

(3) 13th November 2020

- FREE first car servicing

- used Shell Helix Ultra 0W-20 Fully Synthetic Motor Oil

For the past 5 months car driving experience, I only can say this Honda Civic 1.5 Turbo indeed is a fun car to drive!

Simply LOVE it !

Picked latest color in year 2020: Coffee Cherry Red Metallic.

Divine Exchange. :) Traded in 5 years old Toyota Altis for S$50,000.

Honda Civic 1.5 Turbo engine.

After NanoBlack coatings.

Used during the first FREE car servicing at Honda Service Centre.

Updated on January 4, 2022

========================

Keep track the petrol usage for fun. : )

The Honda Civic 1.5 Turbo has a petrol tank size of 47 liters.

One year net car petrol cost S$2,136.77.

That's S$178.06 per month.

Total distance traveled within a year: 12,378KM.

Total 1 year spent (1st year) : S$3,489.86 . Average per month: S$290.82.

I don't have to go through ERP gantry to work and also no ERP gantry when I drive back home.

I also do not have to pay for car park fee at work place as well as the residence place.

However, I do have to pay car park fee elsewhere and that can round out the average spent per month to be S$300.