There are few CPF warriors on social media. We can learn from them.

The number 1 CPF warrior shall be ASSI ( AK71, born in 1971 probably).

He is so famous until many had used him as the benchmark. The graph below shows the graph of the OA balances.

I don't know why the author only focused on OA balance but I would love to see the graph for the total balance of the entire CPF account instead.

AK71 CPF balance is astonishing. He received S$31,207.95 interest in year 2021.

That's S$1.08 million at the tender age of 50, 1.08M50 (alone). Very impressive.

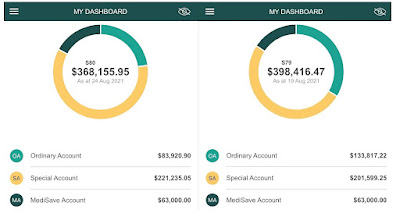

Another folk born in year 1975.

Good amount of monies in CPF OA, probably use cash only for housing loan?

It is quite weird that the MA account has not reached the basic healthcare sum (BHS) of S$63,000.

Mr. Loo has a pretty good homerun at his CPF OA by turning S$300,000 in OA to be S$423,000++ in just about a year plus.

He basically dumped the CPF OA during the COVID era (April, May, June 2020) through Endowus platform by buying S&P 500. A very good catch indeed.

1.27M48 achieved with combined S$470K+ in OA, S$590K+ in SA and S$127K+ in MA.

Two OA millionaires here, said to be age 56, and 57. (Retirement Account had been formed).

It is quite obvious that they both selected Enhanced Retirement Sum (ERS), that's why the RA account now is about S$300,000++.

They did not do the SA shielding at the age of 55 as they both have low figures at SA account.

If they have done the SA shielding, they will earn much more interest in the SA account instead of leaving S$1 million ++ in OA account.

Their CPF balances had further accelerated to S$1.762 million and S$1.619 million.

Both of them are 2 years younger than PT, so PT is 59 then. :)

PT has a CPF balance of S$1.787 million.

The PT couple, probably the KING of the CPF Warriors, 3.26M59

He published a lot of information on social media which are good for our reference/benchmark.

This ah boy reached FRS sum at SA at the age of 30. You can watch his video clip at Chris-HoneyMoneySG. Basically, you just follow the main first two procedures as early age as possible and you will be there (reaching FRS sum at SA) at the soonest.

(1) CPF SA & MA top up every year (to the maximum limit for tax relief).

(2) CPF OA to SA transfer.

(3) Do not use CPF OA to pay housing loan (if you own one).

One more CPF millionaire spotted.

PB, 1.3M59 ( alone ) or 2.9M59.

1M47 (alone) spotted.

This is the best achievement seen so far.

March 11th, 2022 will be her 48th birthday. CC.

Who will be the next CPF warrior?

I would love to kick start my son CPF balance at the higher ground, currently S$44,515 @ age 9.

It is a good racing game, a rat race. LOL.

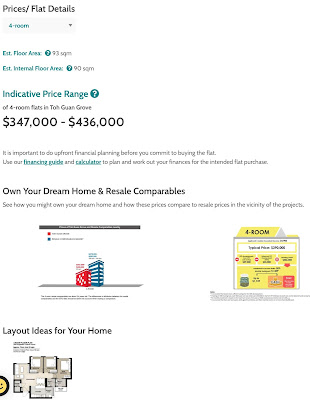

P/S: We are on track to achieve 4M65.

Currently at 0.85M42 (as of July, 2022).

Or 1.13M42 (CPF Regrossed Balances, including the OA monies paid to the HDB private housing loan, Endowus/stocks purchase).