CPF annual report 2020 just released !

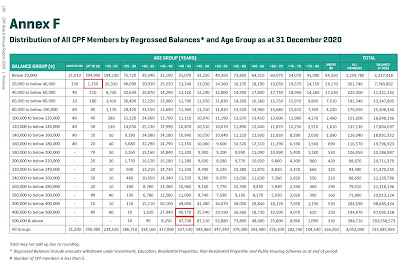

Benchmark our CPF balances with the national data with the "All CPF Members" table.

Here are the subsequent years of CPF data for references from year 2014 to 2020.

Some interesting points:

(1) They only published ALL CPF members data in year 2019 and 2020. In fact, they published ACTIVE CPF members data from year 2014 to year 2020.

(2) They used to publish the highest category of S$150K & above only from year 2014 to year 2018 but from year 2019, they now also publish additional 10 higher tier categories with the highest category of S$500K & above. Maybe they shall publish all the way to S$1million & above category in the future too.

(3) From the ACTIVE CPF members data from year 2014 to year 2020, you can see there is a steadily increase of members in the S$150K and above category at age group of 50-55. The percentage shoot up from 71.5% to 84% (corresponding to the total active members at age group of 50-55. It is a healthy increment. That actually says 84% of the active CPF members at age 50-55 group is able to meet the Full Retirement Sum (FRS). Good trend. Provided that they do not use too much OA monies on housing loan.

(4) As for ALL CPF members data from year 2019 to year 2020, let's look at the youngest category of "up to age 20", the top categories S$300K to 400K remains the same as 10 members. There is an additional 100 members at S$80K to S$300K range and an additional 50 members at S$60K to S$80K range, etc. Interesting, more and more parents are topping up their kids' CPF account obviously.

(5) 840 members having S$40K and more in the "up to age 20" group. This number will continue to rise. It has increased 38% from 610 members in year 2019. My son will join this “S$40K and more” category next year too. :)

No comments:

Post a Comment