Many people nowadays are mesmerized by their net worth.

Net worth is the value of all assets, minus the total of all

liabilities.

In other words, net worth is what is owned minus what is

owed. Simple.

Basically, the typical liabilities of Singaporean are either

mortgage loan or car loan or both. That’s all about it or at least these are

the two big ticket items.

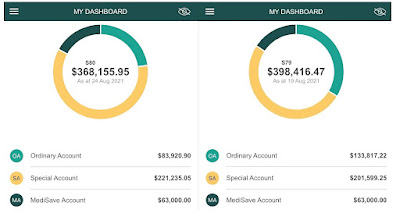

Hence, I also keen to join the hype and calculate our

net worth too!

What’s our liabilities? Mortgage loan and car loan la! See, it’s very common. I just told you! :)

Above properties AssetsValue = Market Value - Loan Liabilities

As of today (October 11, 2021), we still have a private home mortgage loan (liabilities) of S$856,612, car loan (liabilities) of S$64,033. In total, net liabilities of S$920,645. Nice. :(

You can obtain your monthly properties market value update from SRX. It is a very good information. We have cleared the HDB mortgage loan.

The 4-room HDB flat has a market

value of S$484,000, hence, that’s one of our good asset that generates a

monthly passive income of S$2,150 (since 5 years ago).

The 4-bedrooms private property has a market value of S$1,630,000.

As for the car, even it has a liability of S$64,033, it also has an "asset value" of at least S$14,487. That is my car scrap value if I have to continue to drive the same car for another 9 years until the entire 10 years COE is expired. That says I will get back this value of S$14,487 in October 2030.

Not too

bad la. It is a fun car to drive.

Hence, just for the 3 biggest assets calculation, we stand to have a net worth of S$1.207 million.