Revision 04 (last paragraph): updated on April 3, 2021

Revision 03: updated on March 7, 2015

Revision 02: updated on October 6, 2014

This blog is EXCLUSIVELY for Singtel MIO Plan customer. If you are Singtel mio Plan customer, you should pay attention to this blog.

Revision 02: updated on October 6, 2014

This blog is EXCLUSIVELY for Singtel MIO Plan customer. If you are Singtel mio Plan customer, you should pay attention to this blog.

I received the letter from Singtel informing me that mio Plan will no longer be available for re-contract. I had signed up this great Singtel plan since year 2006.

I have two options (Fibre options below are not available for public, only for mio Plan customers):

Option1: COMBO 2 mobile plan + Fibre Home Bundle (100M)

Mio Plan customers are given special price on Fible Home Bundle which is only S$34.95 per month. COMBO 2 mobile plan is the same as public, which is S$42.90 per month.

Option 2: COMBO2 mobile plan + Fibre Entertainment Bundle (100M)

Mio Plan customers again are given special price on Fibre Entertainment Bundle which is only S$59.90 per month. COMBO 2 mobile plan is the same as public, which is $42.90 per month.

It is not difficult for me to decide which option to go, clearly option 2 is the most valuable one and why?

(1) Option 2 can enjoy yearly handset upgrade just like mio Plan but Option 1 can’t.

(2) Option 2 can enjoy mobile multi-line discount of up to 30% for five Singtel Mobile lines but Option 1 can only enjoy 10% discount for 1 line only.

(3) Option 2 can enjoy free waiver of S$235.40 OPENNET installation but Option 1 can’t. It is my bad rejected OPENNET installation last time but now it is a must to have this OPENNET installation. Please take note!

(4) Either Option 1 or Option 2, both plan Singtel is giving me additional S$200 hand phone discount.

A big WOW, I just re-contract my line in March 2014 with a Samsung Galaxy tab for only S$30 and I sold it at hardwarezone.com for a cool S$280. And now shortly after 7 months, Singtel allows me to do the re-contact yet again! Usually mio Plan customer can re-contract after 12 months. Not only Singtel allows me to do the re-contract after 7 months, they even give me a S$200 hand phone discount! This offer is valid until October 31, 2014. Simply too good to be true.

So, with COMBO 2 plan, iphone 6 costs SGD 508, free SGD 200 discount from Singtel, trade in price of iphone 5 (from Singtel) is SGD 200, I only need to pay SGD 108 for a brand new iphone 6. BUT GUESS WHAT? I managed to trade in my iphone 5 (16GB) for SGD 320 on September 26 at EZY Mobile shop at Holland Village. They paid SGD 120 more than Singtel ! In short, I traded in my iphone 5 with iphone 6 for FREE and yet I gain S$12. Ha ha. That's really cool !

Or stick to your iphone 5, and sell your iphone 6 for S$1,000 or more at hardwarezone again, why not? Then, your 2 years phone bill is completely FREE. :)

How much we are really paying if we opt for Option 1 or Option 2.

If I choose Option 1, my mobile phone can enjoy 10% but my wife mobile line will have 0% discount.

So, two of us, 2 years cost us S$2,213.04

If I choose Option 2, (I had gathered 3 more Singtel mobile line to enjoy 30% ) my mobile and my wife mobile both can enjoy 30% discount. You MUST take this benefits.

So, two of us, 2 years cost us S$1,698.24, that’s instant saving of S$514.80. That is mobile plan.

As for Fibre plan:

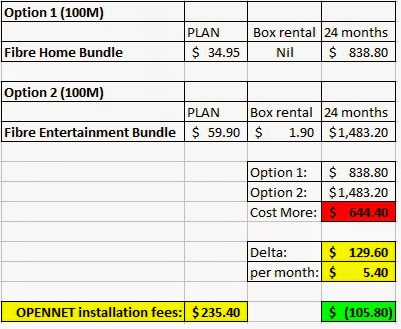

If I choose Option 1, Fibre Home Bundle, it is easy, I need to pay S$34.95, 2 years S$838.80.

If I choose Option 2, Fibre Entertainment Bundle, I need to pay S$61.80 per month (take note on the rental box of S$1.90 charges per month), 2 years S$1,483.20.

So, the difference is ONLY S$129.60 EXTRA for the entire 24 months contract by calculating the cost saving of mobile plan, S$514.80. That is ONLY S$5.40 EXTRA PER MONTH for you to watch 55 oversea TV channels, include Bloomberg, National Geographic Channels, Disney channels for your kids, etc.

But WAIT, for me, if I choose option 1, I have to pay OPENNET installation fees of S$235.40. That is just me. I know many of you get this done for free but if you have not done so, please make sure you have this installed else you will face problem in the future.

So, with that installtion fees come into calculation, I actually got completely FREE 55+ TV CHANNELS and yet I SAVE S$105.80 if I choose option 2. Furthermore, I can have new handset upgrade every year and I make 3 more friends happy to enjoy 30% discount on their mobile line.

What a great plan from Singtel.

Now, who can tell me what is the good bargain for a nice Ultra High Definition (UHD) LED TV at the current market? :)

Oh ya, by the way, please make sure you pay all the Singtel bills using OCBC 360 credit card, you got the entire bill a further 3% discount. Effectively, your mobile plan is 33% discount per month, like it?

IN SUMMARY (my case):

(1) IF and ONLY IF mio Plan still exist (not possible):

MIO PLAN + 1 MOBILE LINE (30% discount)

24 months - S$2,684.40

(2) If I choose only Fibre Home Plan:

Fibre Home Plan (10% for MOBILE LINE) + 1 MOBILE LINE (No discount given)

24 months = S$3,287.24

(3) If I choose Fibre Entertainment Plan:

Fibre Entertainment Plan (30% for MOBILE LINE) + 1 MOBILE LINE (30%)

24 months = S$3,181.44

Decision made: I have signed up for Fibre Entertainment Plan. Next hunting for a new UHD LED TV. :)

Updated on October 6, 2014

====================

I had purchased a LG 49UB850T model, Ultra High Definition , 49 inch, 4K Cinema 3D Smart TV from Courts at JEM mall on September 28, 2014. The TV delivery and installation was on October 4 and I found out the price difference of S$110 at Best store at IMM mall on October 5 , hence Courts has a policy for their buyer to get a refund of double the price difference, so I got S$220 ! :) There are also many promotion going on right now.

I total paid S$2,198 on the bill. With all the LG promotion, Courts in-house promotion, refund of double the price difference, Standard Chartered Manhattan credit card 3% cash back, etc.

I total received S$520 vouchers (combination of NTUC and Courts vouchers) and cash back of S$96.

Hence, you can say I total pay S$1,582. :)

My TV selection is rather simple. I want a Smart TV, 50 inch preferably. This TV has a refresh rate of 1,000 Hz ! Resolution of 3840 x 2160. The 3D feature just come with it. :)

The TV packaging.

Courts refund of double the price difference policy.

My TV at home!

Mio TV installation only took 40 minutes and I am given two wireless network channels to choose from. One is 5G wireless network. :)

Based on the speedtest.net test results, my home 5G wireless network yields download speed of 92 Mbps and upload speed of 114 Mbps. That's close to my 100 Mbps broadband subscription.

Based on the speedtest.net test results, my home 5G wireless network yields download speed of 92 Mbps and upload speed of 114 Mbps. That's close to my 100 Mbps broadband subscription.

I chose the most basic mio TV channels which has the following 55 channels. :)

Updated on March 7, 2015

====================

This is a typical normal bill of the cheapest SINGTEL MIO TV plan package you can get in Singapore. If you are STARHUB customer, please share your bill too as I am curious to know as well.

MIO TV program + 200 Mbps wireless broadband + MIO Home Voice = S$ 61.80 (including GST)

Cell phone package = S$35.38 (including GST, caller ID and 30% bundle discount)

Payment made by OCBC 365 Credit Card, you enjoy further 3% cash rebate.

In short, I paid S$94.26 on SINGTEL bill every month!

I am a long time happy customer of SINGTEL since year 2004. I should buy their stock too!

Furthermore, SINGTEL recently upgraded my broadband speed from 100 Mbps to 200 Mbps FREE. How crazy is that? Simply love it !

Updated on April 3, 2021

======================

It is time to update my SingTel plan after 6 years! I am still a happy SingTel customer since year 2004.

I just re-contracted my SingTel Mobile in March 2021, SingTel Fibre Broadband and SingTtel TV in April 2021. Net monthly payment is S$106.93. :)

(1) I decided to keep using my iPhone 11 Max Pro. Hence, I re-contracted SingTel Mobile plan to get a new iPhone 12 Max Pro and re-sold it at the gain of S$322.

It is still a SingTel Combo 2 plan with Caller ID and DATA x 3 features. More than enough for me.

(2) I re-contracted the SingTel Fibre Broadband (1Gbps) with FREE 4 months fees, a saving of S$199.50.

(3) I also re-contracted the SingTel TV (Family Starter) with FREE 3 months fees, a saving of S$89.70.

Total savings of S$611.30 to re-contract all 3 SingTel plans for another 24 months.

My next re-contract eligibility will be in September 2022 (for SingTel mobile plan, just in time for Apple iPhone 14 launch) and January 2023 (for SingTel Fibre Broadband and SingTel TV plans).

One task done. :)

I re-contracted and received the iPhone 12 Pro Max 128 GB (Pacific Blue) on March 1st, 2021.

I do not enjoy the S$50 off handset with 5G as I continued with my 4G plan instead, hence I paid S$1,238 for the phone.