CPF Annual Report 2022 had just been released!

They had removed the most exciting annex table that they had tabulated for many years, simply because they do not want people to keep comparing with others within the same age group. It's like remove the class standing in the primary school examination. Not fun at all.

Nevertheless, below are the highlights from CPF Annual Report 2022.

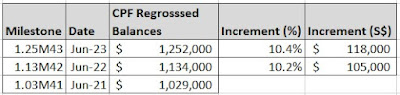

With CPF regrossed balance definition, we have a combined S$1.25million dollars in CPF as of June 30th, 2023. :) That sounds better.

Net CPF balance in CPF account is S$951,677.

We will surely break the S$1 million mark in net CPF balance by January 1st, 2024!

The key is to stay employed.

The CPF regrossed balance includes the monies you

have spent on investment / housing loan / education, etc. .

I

personally think that is the right way of calculating as that shows your ability to draw cash

into the CPF account (be it yourself or from the employer

contribution).

Nevertheless,

it excludes how well your stocks/ Endowus performance in the CPF OA account as

they only count the amount you throw in.

That says, if your stocks/ Endowus perform well above 2.5% given by the CPF OA, you will expect much larger sum the moment you sell and return back to CPF OA!

Vice versa. Nevertheless, I only have a small exposure of S$34,101.

We have achieved 1.25M43 and on track to 4M65!

Based on the 3 years growth data, it is quite easy to predict that we will have at least S$100,000+ annual growth in CPF balance. That's about 10% annual increment.

Last but not least, everyone must know how to project their own CPF balances.

No comments:

Post a Comment