Yup, on the first day of the new year 2022, we topped up our CPF accounts. We topped up maximum of S$3,000 each in our CPF MA account to reach Basic Healthcare Sum (BHS) of S$66,000 for year 2022. That will give us a good tax saving for year 2023.

We also topped up S$6,428.44 into our kid CPF SA account to make the SA sum to be S$40,000.00 It will yield an interest of S$2,000 by the end of this year. 5% interest. Sweet!

S$29,767.04 total CPF interest received today...

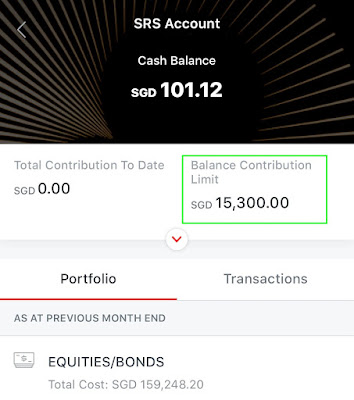

I have one good suggestion to do SRS S$15,300 top up if you want to preserve your cash for rainy days.

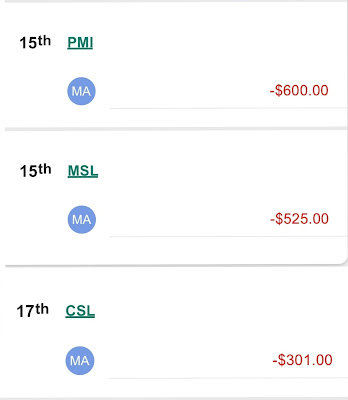

It is defined as: sell your stock that was purchased in the cash account and

re-purchase it immediately with SRS account.

The strategy is like CPF SA shielding just before the age of 55.

You take out the CPF SA monies and park them elsewhere for few days then put them back to CPF SA account once the RA account is formed.

For example, if you have 1,000 DBS shares that you had purchased with cash in the past and the DBS stock price today is S$32. You can just use cash from your saving account (S$15,300) to top up into SRS account and you buy DBS shares at S$32. At the same time, you sell your DBS shares ( that you had purchased in cash) and the sale proceed goes back to your saving account. Done!

So, literally you are transferring your DBS shares from cash account to SRS account and you enjoy good tax savings! Why not? You do this ONLY IF you don't have enough extra cash to top up into SRS account.

Of course, one will argue that it incurs the buying and selling charges but that amount is so small compared to the massive tax saving you are going to celebrate the following year. : )

I have re-invested close to S$160,000 into equities through SRS account.

I have yet to top up S$15,300 into the SRS account for the year 2022 but will do so soon.

No comments:

Post a Comment